The invention of cryptocurrency is a major innovation in the digital world of the 21st century. With the rising popularity of this new form of digital currency, many economists have started predicting a major change in the future of the world economy. Back in the day, when cryptocurrency was at its initial stage, there was just one kind of cryptocurrency people were talking about – Bitcoin. However, following the success of Bitcoin, a lot of new cryptocurrencies have come into the market today. With so many cryptocurrencies to choose from, it can be a daunting task to choose the right cryptocurrency for investment, especially if you are a new investor. This is the perfect article for you if you are looking for a guide to cryptocurrency investment.

How to start investing in cryptocurrency?

This guide to cryptocurrency investment is for new investors. However, if you are already invested, you could gain some insights as to what are the parameters you need to scale your investments on.

-

Gather information on the different kinds of cryptocurrencies.

Information gathering is an important step in the process of investment. You need to know all about the fundamentals of a digital asset and the risks involved before making an investment. Learn about the different kinds of cryptocurrencies and compare their values. Understand the market capitalization. This will help you in making the best decision for your investment.

-

Decide on the type of investment you want to go with.

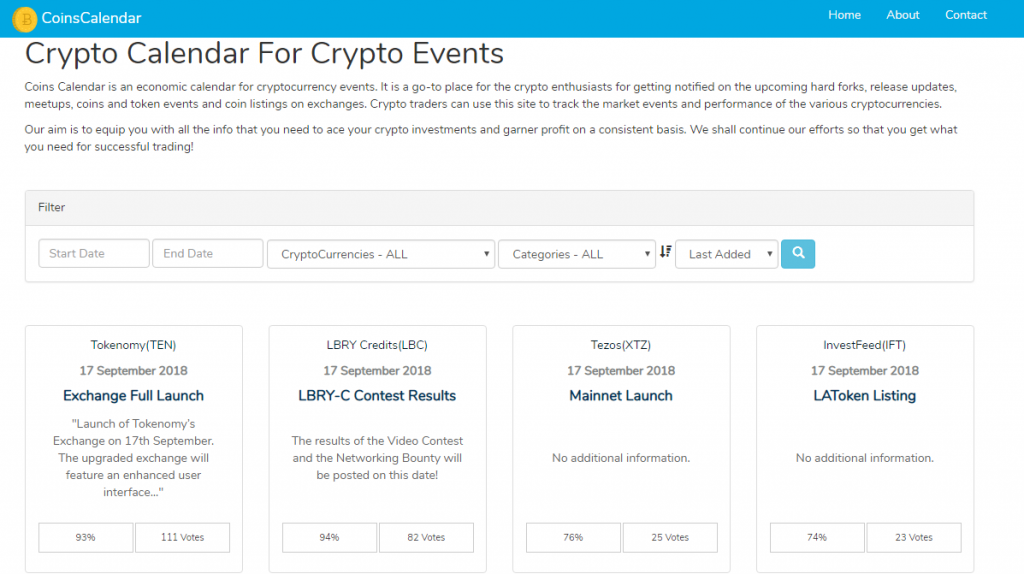

Before making an investment, be sure to analyse the various options for investment. Be specific about your period of investment. You can opt for short-term investment, medium-term investment or long-term investment. If you want to be invested regularly, you need to stay updated with the latest news and updates from the world of cryptocurrency. You can follow this online crypto calendar for all the latest news, updates and announcements related to cryptocurrency.

-

Go for trustworthy and accepted digital assets.

As with any kind of investment, trust is an essential factor for investment in digital assets. You have to be absolutely confident about your investment before you actually go ahead and put your money in buying cryptocurrencies.

-

Dive into the case studies of major crypto investors

A case study is the best way to learn about the success or failure of a cryptocurrency. The crypto market is volatile. Therefore, being aware of the risks is a crucial factor in securing your investment portfolio. Case studies can help you learn why and why not to invest in certain kinds of cryptocurrencies.

We hope you found this article useful and informative. If you want to know more about cryptocurrency or online crypto calendar, let us know in the comment section below. Also, let us know your suggestions and questions about cryptocurrency investment. Share your tips with us if you have any. We would be glad to get in touch with you. To show your support, share this post with your friends on social media and elsewhere. Thank you very much for reading.